- General

- Monday 26th August 2019

- Author: Shreya Uppal

Highlights

-

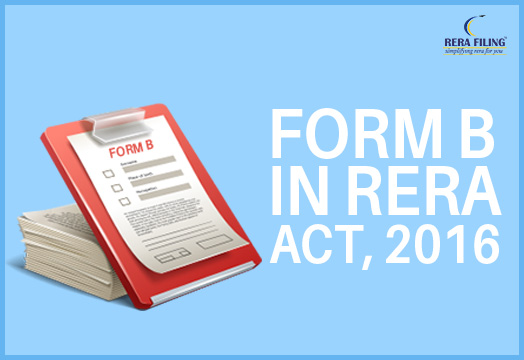

An application for the registration of the project shall be filed with certain pre-defined documents which shall comprise of Form B too

-

It is basically an affidavit cum declaration that is submitted by the promoter while registering his application for the project with the respective RERA Authority

-

Rules of various states have their own prescribed format for Form B.

As per the RERA Act, 2016 an application for the registration of the project shall be filed with certain pre-defined documents which shall comprise of Form B too. Rules of various states have their own prescribed format for Form B.

General points regarding Form B

1. It is basically an affidavit cum declaration that is submitted by the promoter while registering his application for the project with the respective RERA Authority.

2. It can be either self-attested by the promoter himself or his duly authorized signatory.

3. It is primarily submitted by the promoter to inform the authorities about its estimated completion date of the project. It is also submitted while filing an application for the extension of the project.

4. Some of the declarations that are declared and verified in Form B are described below:

(a) The promoter has legal valid authentication of the land on which the development shall be carried out for which legal title report has been obtained.

(b) The details of encumbrances along with the details of the parties involved shall be declared, finally declaring whether the land is free from all encumbrances or not.

(c) Section 4(2)(l)(D) of the RERA Act, 2016 has been duly complied with stating that 70% of the amounts realized by the promoter for the real estate project from the allottees, from time to time, shall be deposited in a separate account to be maintained in a scheduled bank to cover the cost of construction and the land cost and shall be used only for that purpose. The amounts from the separate account, to cover the cost of the project, shall be withdrawn in proportion to the percentage of completion of the project.

(d) The amounts from the separate account shall be withdrawn after it is certified by an engineer, an architect and a chartered accountant in practice that the withdrawal is in proportion to the percentage of completion of the project.

(e) The promoter shall not discriminate against any allottee at the time of allotment of any apartment, plot or building, as the case may be, on any grounds.

All other specific points differ from state to state which can be known from their specific rules only.

For Project Registration, Click here.

Tags: allotment , separate, title report, encumbrances.

Copyright © 2026 RERA Filing. All rights reserved.

Rera Act

Rera Act

Maharashtra

Maharashtra

Karnataka

Karnataka

Telangana

Telangana

Andhra Pradesh

Andhra Pradesh

Delhi

Delhi

Uttar Pradesh

Uttar Pradesh

Haryana

Haryana

Gujarat

Gujarat

Bihar

Bihar