- General

- Tuesday 28th April 2020

- Author: RIYA KAPOOR

Highlights

-

From 01 June 2013, TDS OF 1% is required to be deducted on all purchase of property above Rs 50 Lacs.

-

The onus is on the buyer to deduce the TDS, not the seller. Also, the pan card of both buyer and seller is mandatory to be disclosed. If the Pan card will not be there, TDS will be deducted at 20%.

-

TDS deducted should be deposited to govt by the end date of next month in which TDS is deducted.

From 01 June 2013, TDS OF 1% is required to be deducted on all purchase of property above Rs 50 Lacs. This clause is applicable if the seller is a resident Indian. If payment to the seller is made in installments then TDS is required to be deducted in installments only. Sec 194 IA of the Income Tax Act, 1961 states that for all transactions with effect from June 1, 2013, Tax @ 1% should be deducted by the purchaser of the property at the time of making payment of sale consideration. The tax so deducted should be deposited to the Government Account through any of the authorized bank branches.

For example, A buys a property from B of total Rs 80,00,000. He made a payment of Rs 30,00,000 on 21 April 2019 and another installment of Rs 50,00,000 on 24 January 2020.TDS of Rs 30,000 will be deducted on 21 April 2019 and TDS of 50,000 will be deducted on 24 January 2020.

Who is liable to deduct TDS?

The onus is on the buyer to deduce the TDS, not the seller. Also, the pan card of both buyer and seller is mandatory to be disclosed. If the Pan card will not be there, TDS will be deducted at 20%.

Date to deposit TDS deducted?

TDS deducted should be deposited to govt by the end date of next month in which TDS is deducted. So in the above-quoted example, TDS of Rs 30,000 will be deposited by 31 May 2019, and TDS of Rs 50,000 will be deposited by 29 Feb 2020.

Budget 2019 changes

From 01 September 2019, other payments such as club membership fee, car parking fee, electricity and water facility fees, maintenance fee, advance fee, etc which are incidental to the transfer of the property will be included in the term “ ‘consideration for immovable property’ and will be subject to TDS.

In the above example, let's say we paid Rs 80 lacs as sale consideration along with Rs 2 lacs electricity charges, 3 lacs as parking charges. TDS of Rs 85000( 1% of (80L+2L+3L)) will be deducted.

Deposit of TDS

The buyer is required to deposit the TDS deducted by filing FORM 26QB. After successful submission of form 26 QB, Form 16 B will be generated within 10-15 days which buyers need to send to the seller so that he can the TDS in Income Tax Return.

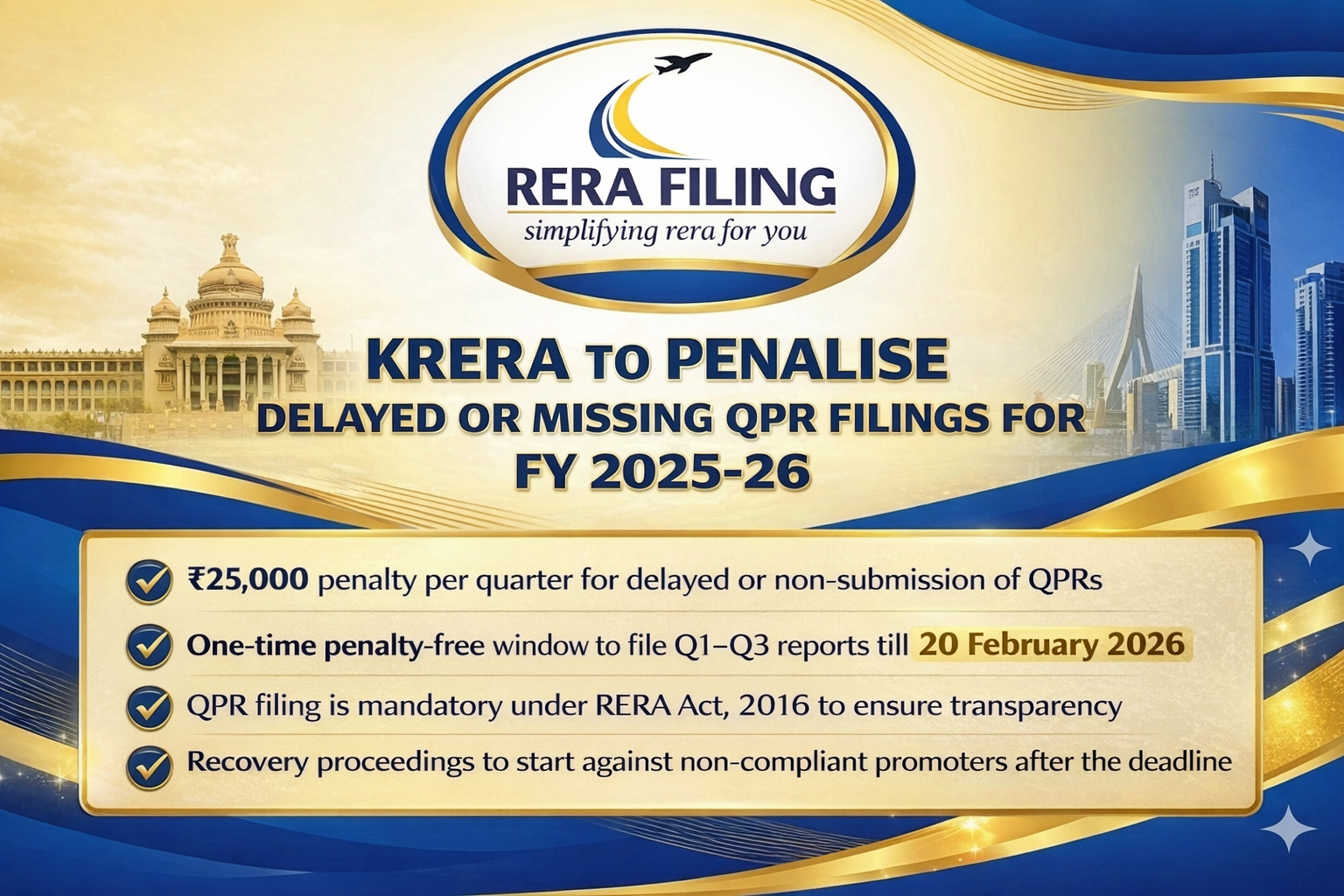

Copyright © 2026 RERA Filing. All rights reserved.

Rera Act

Rera Act

Maharashtra

Maharashtra

Karnataka

Karnataka

Telangana

Telangana

Andhra Pradesh

Andhra Pradesh

Delhi

Delhi

Uttar Pradesh

Uttar Pradesh

Haryana

Haryana

Gujarat

Gujarat

Bihar

Bihar